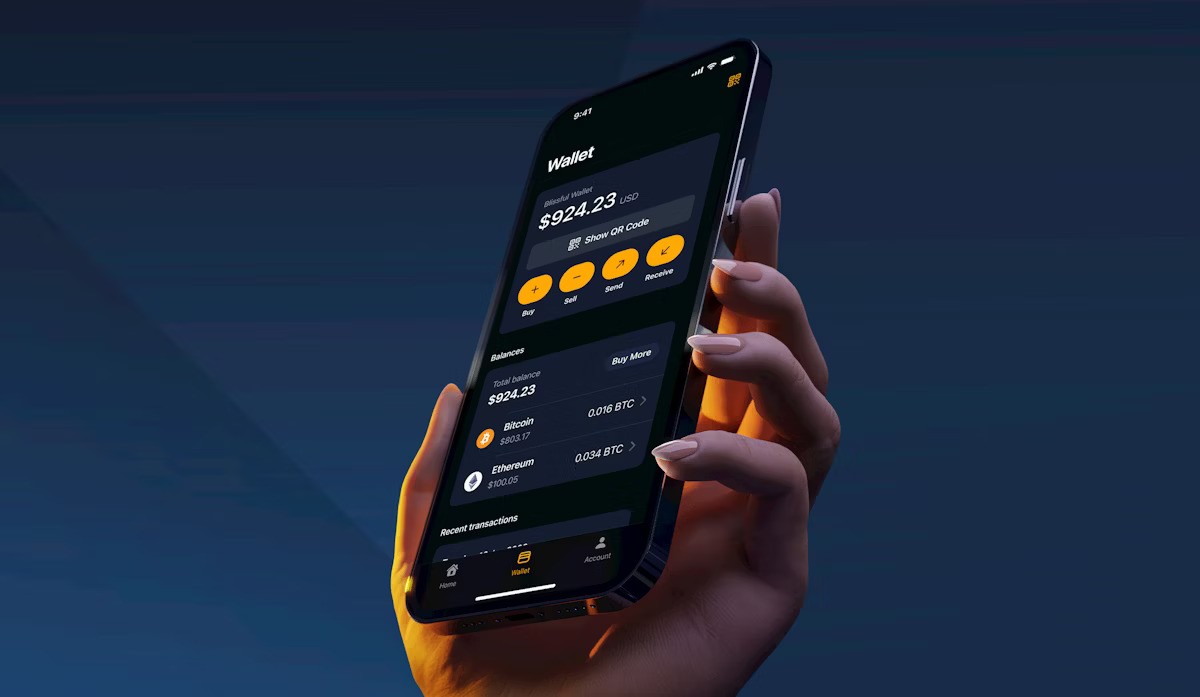

In the world of cryptocurrencies, a crypto wallet is one of the most important tools for managing digital assets. Whether you’re an experienced crypto investor or a newcomer exploring blockchain technology, understanding what a crypto wallet is and how it works is essential for safely storing MetaMask, sending, and receiving cryptocurrencies like Bitcoin, Ethereum, and many others.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store and manage their cryptocurrency holdings. Contrary to traditional wallets, which hold physical currency, a crypto wallet doesn’t actually store cryptocurrency itself. Instead, it stores private keys—cryptographic keys that enable access to the digital assets stored on a blockchain.

These private keys are critical because they serve as proof of ownership of the coins or tokens in your wallet. If you lose your private key, you lose access to your funds, which is why safeguarding them is of utmost importance.

Types of Crypto Wallets

Crypto wallets come in several forms, each offering varying levels of security, convenience, and control. The most common types include:

- Hot Wallets (Software Wallets): Hot wallets are connected to the internet, making them more convenient for frequent transactions. They are typically available as desktop or mobile apps. Some popular hot wallets include Metamask, Exodus, and Trust Wallet. While they are easy to use, hot wallets are more susceptible to hacking since they are always online.

- Cold Wallets (Hardware Wallets): Cold wallets are offline devices that store private keys. They are generally considered the most secure type of wallet because they are not connected to the internet, reducing the risk of cyberattacks. Hardware wallets like Ledger Nano S and Trezor are physical devices that you plug into a computer or smartphone when you need to access your funds. Cold wallets are ideal for long-term storage of large amounts of cryptocurrency.

- Paper Wallets: A paper wallet is a physical printout of your public and private keys. While they are completely offline and free from hacking risks, paper wallets can be easily damaged or lost, making them less practical for daily use. However, they can still serve as a secure option for long-term storage if handled properly.

- Web Wallets: Web wallets are browser-based wallets that store private keys on an online server. These wallets are accessible from anywhere with an internet connection, but they are controlled by third parties, meaning that the provider holds the keys to your assets. While convenient, web wallets can be vulnerable to attacks, making them less secure compared to cold wallets.

How Crypto Wallets Work

Crypto wallets operate using two main components: public keys and private keys.

- Public Key: This is like your account number. It is a cryptographic address that others use to send cryptocurrency to your wallet. Public keys are shared openly and do not pose any security risks.

- Private Key: This is the most important part of the wallet. The private key is like your password—only you should know it. It is used to sign transactions and provide access to your cryptocurrency holdings. If someone gains access to your private key, they can take control of your funds.

When you want to make a transaction, you use your private key to sign it, verifying that you are the rightful owner of the coins being sent. This signed transaction is then broadcast to the blockchain, where it gets verified and added to the ledger.

How to Choose a Crypto Wallet

When selecting a crypto wallet, there are a few factors to consider:

- Security: This is the top priority. Choose a wallet with strong encryption, backup options, and multi-factor authentication to ensure your assets are safe.

- Ease of Use: The wallet should have an intuitive user interface, especially if you’re new to cryptocurrency. Features like transaction history, easy recovery options, and straightforward settings are essential.

- Compatibility: Ensure that the wallet supports the cryptocurrencies you plan to store. Not all wallets support every type of digital asset.

- Backup and Recovery Options: Losing access to your wallet is a nightmare, so choose one that offers backup features such as seed phrases or recovery phrases, which allow you to restore your wallet if your device is lost or damaged.

- Customer Support: Good customer support is vital, especially if you’re using a more complex wallet. Look for wallets that offer responsive and knowledgeable support teams.

The Importance of Security in Crypto Wallets

Security is a crucial consideration when dealing with cryptocurrencies, as they are a prime target for hackers. The decentralized nature of crypto means that there is no central authority to protect your funds if your wallet is compromised. To protect your digital assets:

- Use strong passwords and enable two-factor authentication whenever possible.

- Regularly back up your wallet to avoid losing access to your funds in case of a device failure.

- Avoid storing large amounts of cryptocurrency on hot wallets, which are connected to the internet.

- Store your private keys offline and ensure they are kept in a safe place, like a hardware wallet or a paper wallet stored in a secure location.

Conclusion

Crypto wallets are the cornerstone of cryptocurrency ownership and management. Whether you’re trading, investing, or just holding digital assets for the long term, choosing the right wallet is crucial for ensuring that your funds remain safe and easily accessible. Understanding the different types of wallets, their security features, and best practices for protecting your private keys will help you navigate the world of digital currencies with confidence.